|

September 11, 2023 RE: CY2024 Medicare Physician Fee Schedule Proposed Rule Dear Administrator Brooks-LaSure: The National Association of ACOs (NAACOS) appreciates the opportunity to submit comments in response to CY2024 Medicare Physician Fee Schedule (MPFS) and Medicare Shared Savings Program (MSSP) proposed rule. NAACOS represents more than 400 accountable care organizations (ACOs) in Medicare, Medicaid, and commercial insurance working on behalf of health systems and physician provider organizations across the nation to improve quality of care for patients and reduce health care cost. NAACOS members serve over 8 million beneficiaries in Medicare value-based payment models, including the MSSP and the ACO Realizing Equity, Access, and Community Health (REACH) Model, among other alternative payment models (APMs). NAACOS is pleased that CMS continues to work to improve and enhance MSSP. We are especially gratified by your proposals to cap the regional risk score, use the same risk model in the benchmark and performance years, and offer a new quality reporting option for ACOs. Many of these policies are responsive to concerns and suggestions raised by our members. Additionally, several physician payment policies better support team-based care and recognize the effort needed to address patients with complex needs; these services are building blocks toward population health. We thank CMS for its attention to these issues and ask that CMS employ policies that will encourage more rapid adoption of ACOs and population health. NAACOS supports CMS's stated goal of having all Medicare beneficiaries in a relationship accountable for quality and total cost of care by 2030. As the only permanent total cost of care model, CMS must ensure that current MSSP participants remain in the model and that the model attracts new clinicians and other providers. CMS should do the following to accomplish this goal:

PHYSICIAN PAYMENTPhysician Payment CMS proposes a CY 2024 Medicare conversion factor (CF) of $32.75, a decrease of 3.34 percent from the 2023 CF rate of $33.89. NAACOS is concerned that continual cuts create a disincentive for clinicians to adopt population health models. When physician payment is cut, clinicians face an untenable financial landscape on which to adopt value-based care, which takes investment in staff, extra services, and technology. Additionally, as future ACO benchmarks are set on declining FFS rates, benchmarks may not adequately reflect the costs of providing comprehensive coordinated care. We must ensure that clinicians in FFS receive adequate payment and build additional financial and nonfinancial incentives for clinicians to adopt accountable care. Evaluation and Management Additional Payment Changes

MEDICARE SHARED SAVINGS PROGRAMQuality NAACOS is pleased to see CMS proposals to introduce an additional reporting option, Medicare CQMs, to ease the transition to required electronic clinical quality measures (eCQMs) and Merit-Based Incentive Payment System clinical quality measures (MIPS CQMs) reporting for ACOs. We continue to have concerns regarding CMS's larger goal to require all ACOs report all-payer eCQMs/MIPS CQMs, while making no changes to these reporting options. CMS notes this is intended to be a temporary, transitional reporting option. This will result in the same challenges being present for ACOs when the reporting option is eliminated because changes have not been made to the eCQM or MIPS CQM reporting options. The MSSP program-wide pay-for-performance implementation of eCQMs/MIPS CQMs should not move forward without proof-of-concept of both technical feasibility and the impact of the shift to all-payer measurement for ACOs. CMS must also consider future digital quality measurement (dQM) goals and how this proposal works to further that goal. ACOs should not have to invest in developing processes now that will be obsolete soon as other technologies are introduced, like Fast Healthcare Interoperability Resources (FHIR)-based Application Programming Interfaces (APIs). NAACOS continues to advocate for CMS to:

NAACOS continues to have concerns the current state of data standards and interoperability will not yet fully enable ACOs to meet the eCQM/MIPS CQM reporting requirements successfully. While CMS and others often assume that EHR vendors with 2015 Certified EHR Technology (CEHRT) would automatically include the capability to easily report the most recent version of an eCQM for MIPS with minimal manual effort, this is not the case. CEHRT requirements do not standardize the capture and reporting of individual eCQM data elements across vendor systems, and ACOs will need to tailor data extracts and uploads across systems and participating Tax Identification Numbers (TINs). Additionally, not all CEHRT vendors will implement every eCQM required for ACO reporting, since this is not a CEHRT requirement, potentially leaving a gap for ACOs. CMS should make the proposed Medicare CQM changes (limiting the patient population) applicable to the eCQM reporting option as well and work with ACOs to ensure a more digital measurement approach will be feasible. NAACOS continues to have concerns with CMS's timeline to sunset the Web Interface reporting method for Performance Year (PY) 2025. Moving to more digital measurement that is bidirectional and improves clinicians' ability to improve patient care at the point of care is a laudable goal. However, CMS must have realistic timelines when placing requirements on industry. According to a poll of our membership, only 38 percent of ACOs responding said they will be able to report eCQMs in 2025. What's more, this transition is very costly for many ACOs. Forty-one percent of those surveyed estimated a cost of $100,000 to $499,000 and 32 percent estimated more than $500,000 to achieve eCQM requirements for the first year of reporting. Further, many vendors continue to tell ACO clients they are unable to support this work at this time. As a result, CMS should view the Medicare CQM option as a permanent option that is in place until digital quality measurement and reporting is feasible for all ACOs. We continue to believe CMS should pilot eCQMs and dQMs for a subset of ACOs who feel best suited to move forward to identify key challenges and unintended consequences that need to be resolved before moving forward on a program-wide basis. Additionally, CMS should provide incentives for ACOs to do this testing, such as providing pay-for-reporting status for quality measures, upfront funding, adjustments to financial benchmarks, or an increased savings rate to help offset the high costs for doing this work. Medicare CQMs Additionally, we urge CMS to limit reporting of Medicare CQMs to the patient list provided by CMS at the start of the reporting period. CMS notes it will not have full claims run-out information at the time of issuing this list, and therefore it will be incumbent on ACOs to ensure the list is complete. This adds significant burden and instead CMS should limit reporting of Medicare CQMs to the patients included on the list issued by CMS to ACOs reporting Medicare CQMs. Timeline and Availability of Medicare CQMs Data Completeness Benchmarks On review of the existing benchmarking process for MIPS CQMs, eCQMs, and now Medicare CQMs, we do not believe that the process for distributing performance across deciles is transparent nor does this approach as constructed produce information that is meaningful. For example, the current process of determining whether a benchmark can be created appears to be arbitrarily set based on 20 entities reporting at least 20 patients in the denominator, which may or may not yield reliable results. There is also a significant risk of variation and instability in the benchmarks from year to year that may be due to changes in the number of entities reporting on a measure or other random variation rather than representing true differences in performance. The approach also assumes that all measures should be scored with the potential to achieve 100 percent (or 0 percent if it is an inverse measure) and while it may be a laudable goal, it may not reflect clinical knowledge or practical considerations of quality. CMS must revise these methodologies for MIPS CQMs, eCQMs, and Medicare CQMs to increase transparency, consider the impact of random fluctuation, and be adjusted for practical considerations of comparison and relative performance. CMS could consider a process similar to the recent benchmarking of the Web Interface measures where thresholds are not dependent on random fluctuations in performance or because a measure is new to the program, rather they would be defined based on pre-determined distributions of performance. This approach would ensure that the benchmarking process is transparent and predictable and enable ACOs to participate in the program in a more meaningful way. Changes to the Quality Performance Standard Proposal to Apply a Shared Savings Program Scoring Policy for Excluded/Suppressed APP Measures ACO Quality Measure Changes Measure Specific Feedback CMS should also allow for more standardization to occur and to gather data and learn about workflow issues that occur with screenings during a testing/pilot phase where any screening measure would be pay-for-reporting and would not dictate which screening tool was used, or how it was implemented. As an example, some ACOs may choose to do the screening as part of an office visit while others may instead find more value in providing an online screening tool that is completed outside an office visit. Regardless, screening measures should be used as one tool in a larger plan to address health inequities and provide high value care to underserved communities. Further, CMS is currently requiring collection of this data across multiple setting-specific programs, which could result in duplicative efforts and patients potentially having to share this information numerous times. CMS should explore how this data can be shared across providers. NAACOS has provided detailed recommendations on this topic, including more impactful ways CMS could engage with ACOs on this issue. Lastly, we point out that these measures are currently only available for one reporting type and question the feasibility of adding them to the measure set for ACOs. Beneficiary Assignment Modifications to Assignment Methodology and Identification of Assignable Beneficiary Population Use of an Expanded Window for Assignment NAACOS supports efforts to better account for beneficiaries who primarily receive primary care services from non-physician practitioners (NPPs) during the assignment window and who received a primary care service from a physician during the expanded window for assignment. However, we believe CMS needs to establish a more refined approach for defining primary care delivered by these provider types before moving forward. We agree with CMS that the current approaches create challenges for NPPs, including nurse practitioners (NPs), physician assistants (PAs), and clinical nurse specialists (CNSs), to drive assignment in MSSP ACOs. This can be particularly challenging for ACOs that rely heavily on NPPs to deliver coordinated, team-based primary care and struggle to attribute patients as a result. However, we are concerned that the lack of specialty information for NPPs will lead to more specialty-driven assignment from these provider types. While the majority of NPPs practice in primary care settings, we increasingly see more NPPs working in specialty practices, often providing follow up care after an acute event such as a transplant. Because CMS does not have a way to distinguish care provided by NPPs and classifies them all as primary care clinicians, this type of follow up care delivered by NPPs in specialty practices can lead to beneficiaries being attributed to an ACO with which they have no primary care relationship. ACOs report that beneficiaries aligning through specialists in this way tend to be those who are receiving a high-cost procedure in the performance year and do not align to the ACO again in future performance years, making it challenging for ACOs to meet their benchmarks. CMS should investigate the impacts of specialty-driven assignment, including differences in risk scores and costs for beneficiaries attributed via specialists to inform future policy solutions. For example, if data show that these beneficiaries have higher risk scores and higher costs, there could be opportunities to address these challenges through benchmarking and risk adjustment policies. Attribution churn is another area with opportunity for improvement. ACOs struggle to maintain attribution for beneficiaries attributed through specialists because they do not have a primary care relationship with the ACO. CMS should explore strategies to support ACOs in leveraging specialty-driven assignment through NPPs to develop longitudinal primary care relationships with these beneficiaries and advance the goal of having all beneficiaries in an accountable care relationship by 2030. While these proposals mitigate some of these concerns by retaining the requirement for a physician visit in the 12 months preceding the assignment window, the fundamental issue of not identifying NPPs as providing primary care or specialty care remains. ACOs are differentially impacted by this depending on the ACO's composition. ACOs including large multispecialty practices or academic medical centers experience more specialist-driven attribution related to care delivered by NPPs in these settings. As our health care system continues to shift to value-based payment and accountable care, it's important to understand the care that's being provided so that we can better manage and appropriately pay for that care. We urge CMS to work closely with ACOs and ACO participants to develop a workable approach. Possible solutions include leveraging patient relationship codes established under MACRA or updating the Provider Enrollment, Chain, and Ownership System (PECOS) to include practice type for NPPs. CMS could begin by collecting this information as an optional field in the Medicare enrollment application, which already includes a similar field for physician specialty designations. This would provide more information about the type of care being provided by NPPs and enable CMS to align beneficiaries more accurately with their primary care clinicians. Allowing participation at the TIN-National Provider Identifier (NPI) level in MSSP, as opposed to full-TIN participation, would also alleviate these concerns. ACOs in Innovation Center models, like ACO REACH and the Next Generation ACO Model, define participation at the TIN-NPI level and as such, can exclude specialty-focused NPPs from driving assignment. We believe NPPs that deliver primary care, as opposed to specialty care, should play a prominent role in ACO assignment. In the absence of CMS's ability to distinguish between NPPs who practice primary care and those who practice specialty care, we continue to advocate that ACOs be permitted to remove specialty focused NPPs from assignment. Addition of a Step Three to the Assignment Methodology Revision of the Definition of Assignable Beneficiary The simulation of changes to the national assignable population provided in Table 30 only relies on one year of data, PY 2021, which was impacted by anomalies related to the COVID-19 pandemic. CMS should expand this simulation to include additional data years (e.g., 2019, 2020, 2021, and 2022). While CMS estimates that the overall growth in the national assignable population will be small (about 2.9 percent), it does not examine changes to regional assignable populations, which are used in calculations to adjust ACOs' financial benchmarks. We are concerned that rural ACOs could see more significant changes to regional adjustment factors due to smaller population sizes. Because CMS proposes to adjust benchmarks for all ACOs, regardless of agreement start date, based on the new assignment methodology and definition of assignable beneficiary, the agency risks harming current ACOs that may be disadvantaged under the new policies. NAACOS recommends that CMS expand on the simulation and provide additional analyses to assess:

Revisions to the Definition of Primary Care Services Used in Assignment

We believe these services support the delivery of comprehensive, coordinated, whole-person primary care and encourage CMS to finalize their addition to the definition of primary care services as proposed. CMS also proposes to add Remote Physiologic Monitoring (RPM) Treatment Management Services (CPT codes 99457, 99458). While these codes may be billed by primary care providers to support the overall management of a patient's care, the codes can also be billed by specialists and importantly, can only be billed by one treating provider for a given patient. Therefore, if a specialist is billing these codes to support management of a specific condition, that patient's primary care provider would not be able to also provide RPM treatment management services to the patient. Further, because these are monthly billable codes, this could result in the allowed charges for RPM services furnished by a specialist surpassing the allowed charges for primary care services furnished by the PCP. RPM services are newly payable under Medicare in recent years and therefore not reflected in ACOs' historical baseline expenditures. So, while ACOs may provide RPM services as part of care coordination activities, they may be less likely to bill RPM codes because of the impact on performance period expenditures. NAACOS supports the addition of these codes, as we believe they support comprehensive care management, but we encourage CMS to monitor billing of the codes to ensure their addition is not shifting beneficiary attribution away from primary care relationships in favor of specialty care. Finally, CMS proposes to add Office-Based Opioid Use Disorder (OUD) Services (HCPCS codes G2086, G2087, G2088). CMS notes in its proposal that it excludes these codes from CCLFs provided to ACOs and ACOs would not be able see these claims or identify why certain beneficiaries were assigned to their ACO related to these codes. NAACOS opposes the addition of these codes to the definition of primary care services used in assignment until CMS provides this information to ACOs. Despite the fact that Section 3221 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act helped to align 42 CFR Part 2 (Part 2) with HIPAA, ACOs still lack access to vital SUD-related data on their patients due to the fact that under current regulations, care coordination is not considered by CMS to fall under treatment, payment, and health care operations. By aligning Part 2 with HIPAA, the CARES Act allows sharing of this important data after initial patient consent, which will allow CMS to deliver this critical information to providers operating in ACOs. NAACOS continues to advocate for CMS to provide timely, actionable data, including SUD-related data, to ACOs. ACOs rely on data to understand the full spectrum of a patient's care needs and inform evidence-based treatment. Without access to such claims data, ACOs risk treating the whole patient with only part of their data, potentially harming patient care and outcomes. Benchmarking Methodology NAACOS appreciates CMS's commitment to ensuring ACOs are granted fairer, more accurate financial benchmarks, which we have long advocated for. Overall, proposals in this rule, if finalized, will help entice more providers to join the MSSP and keep others in the program. These proposed changes won't help all ACOs but will help level the playing field for those who serve more at-risk, medically complex, or high-cost populations. However, NAACOS cautions CMS that nothing in this proposed rule will solve the ratchet effect, where ACO benchmarks will continue to be lower over time as they reduce spending in their populations and future benchmarks are rebased on lower historic spending. NAACOS implores CMS to consider future changes to mitigate this rebasing problem, which we believe threatens future participation for ACOs working to create a higher quality, more efficient, and more cost-effective health system. More dramatic benchmarking policies are needed to both attract new participants while keeping existing ACOs in the model. As CMS works to address the ratchet effect, we continue to urge CMS to fix the “rural glitch,” where CMS continues to count an ACO's own beneficiaries in the regional benchmarking calculations, effectively penalizing ACOs for lowering the cost of their assigned populations. Additionally, CMS's high-low revenue distinction is continuing to hurt providers who serve vulnerable populations, including rural and safety-net providers. Evaluations show that ACOs with federally qualified health centers (FQHCs), rural health clinics (RHCs), and critical access hospitals (CAHs) as participants are more likely to be classified as high revenue and therefore would be disqualified from receiving some program benefits such as the Advance Investment Payments. In 2020, 71 percent of low-revenue ACOs did not include a FQHC, RHC or CAH. Conversely, 46 percent of high revenue ACOs included 5 or more FQHCs, RHCs, or CAHs. CMS should instead consider alternative approaches, such as evaluating the demographics of the population served by an ACO. The high/low revenue status is arbitrary and leaves out the very ACOs CMS is trying to attract to the program. Lastly, CMS needs to take action to correct an impending issue around drugs in the 340B program. Since a Supreme Court decision last year, CMS has not addressed the disparity between ACOs who paid for 340B drugs at lower prices during their benchmark years and at higher prices during their performance years. This increase in 340B drug prices will continue to hurt ACOs that have 2018-2022 in any of their baseline years for benchmarks. For example, one large ACO has an extra $10 million in annual spending because of this disparity, which is detrimental to their performance as an ACO. We urge CMS to correct this disparity by adjusting its calculation of ACOs' performance year expenditures to correct for this difference in 340B drugs without ACOs having to early renew. This adjustment would help ACOs with 340B providers, who help under-served patients and address the health disparities CMS wants to eliminate. Capping Reginal Risk Score Growth NAACOS supports this change and thanks CMS for listening to our concerns. We have been advocating for a very similar policy. This will incentivize ACO participation in regions with high risk scores and encourage ACOs to care for higher risk beneficiaries. As CMS estimates, 11 percent of ACOs in 2021 would have benefited from this proposed change, a number that would increase as ACOs get further along in their five-year agreement periods and would be more likely to hit the 3 percent cap. As with all these changes to the financial methodology, we encourage CMS to apply this change to all ACOs, not just new agreements. Eliminating the Negative Regional Adjustment NAACOS supports this change as it would remove the disincentive for ACOs with spending higher than their region to participate in MSSP. However, we urge CMS to apply this change to all ACOs, not just those starting new agreements in 2024. While NAACOS understands the reasoning behind the negative regional adjustment, it harms ACOs whose patients are costlier and can work against CMS's health equity goals by shunning providers who serve sicker, possibility more medically complex populations. As CMS notes in the rule, ACOs who receive a negative adjustment are twice as likely to drop out of MSSP. While there's no proposed change for ACOs with a positive regional adjustment, NAACOS reiterates its stance on needing to provide additional help to ACOs who have already lowered costs in their communities. This includes ACOs who receive the full positive regional adjustment or max out their prior savings adjustment. There is effectively a cap on ACOs' savings under these current policies, which should be addressed if CMS wishes to have successful ACOs remain in MSSP. Any cap on savings does not exist in other Medicare programs, including Medicare Advantage. Modifying the Prior Savings Adjustment Introduction of New Risk Adjustment Model Version Mirroring risk model between benchmark years and performance years

Blending of New Risk Model Versions NAACOS supports this change believing that introducing the new V28 risk model over a blended, three-year period is a fair way to incorporate the model into MSSP. Furthermore, it matches how CMS is implementing the model in other Medicare programs. NAACOS also appreciates that this blended introduction is done for all ACOs. We hope CMS could similarly apply other risk adjustment and benchmarking policies to all ACOs, not just those who are starting new agreements. Codifying Risk Adjustment Policies Alternatives include replacing the current 3 percent cap on scores with the possibility of risk adjustment audits, which are currently in place for Medicare Advantage plans. Similarly, CMS could consider a concurrent risk adjustment model, similar to the approach used for high needs REACH ACOs Additionally, CMS should monitor if the move to the V28 model will modify incentives to collect patient risk. CMS could install a cap on risk scores decreasing, which currently doesn't exist. Relatedly, we ask CMS to conduct analysis on the effect of the cap on years later in a five-year agreement period. Advance Investment Payments Policies NAACOS was pleased to see CMS establish the advance investment payments (AIP) option in MSSP through last year's rulemaking, as we have long advocated for CMS to make upfront funding available to ACOs. NAACOS appreciates CMS making refinements and clarifications to AIP policies in advance of implementation beginning January 1, 2024. We share CMS's commitment to supporting the provision of accountable care for underserved beneficiaries and encourage CMS to finalize, with modifications, the proposals as detailed below. AIP Eligibility Requirements AIP Recoupment and Recovery Policies As detailed in past comments, NAACOS recommends CMS further modify AIP recoupment and recovery policies to encourage continued participation in MSSP and consider ACOs' need for sustainable funding. Under current policies, CMS will recoup AIP from any shared savings earned by an ACO until all AIP funds are repaid. As such, many ACOs may not receive shared savings payments for a significant period of time, which could discourage continued participation. While receipt of AIP will help stand up initial ACO infrastructure and activities, annual shared savings payments are crucial to fund sustained initiatives and continual improvement. We recommend CMS recoup AIP funds from a portion of shared savings earned by the ACO so the ACO can fund ongoing initiatives. Termination Policies More broadly, we believe CMS should account for investments with continuing benefits in termination and recovery policies. NAACOS suggests CMS consider an ACO's circumstances and timing of termination, in addition to the investments made with the funds, rather than immediately require all spent and unspent AIP funds be repaid. For example, if an ACO spent AIP funds on EHR upgrades in the initial years of the participation agreement and had to terminate in year four or five, those investments would continue to benefit Medicare beneficiaries and providers even absent the ACO's continued participation in MSSP. We recommend CMS modify termination and recovery policies to take a more thoughtful approach. Reporting Requirements Reconsideration Review Eligibility Requirements Shared Governance Requirement Identifying ACOs Experienced with Risk Based on TINs' Prior Participation NAACOS supports this proposal, and we appreciate CMS's transparency with program operations. To define participation accurately and fairly, we encourage CMS to establish a process whereby ACOs may request reconsideration review if an ACO participant TIN is considered to have participated in an Innovation Center ACO model when only a small proportion of NPIs billing under the TIN participated in the model demonstration. Given MSSP is a full-TIN model and many CMMI models are under “split-TIN” or TIN-NPI participation, it is reasonable to utilize a threshold to determine participation for a TIN which had a portion of NPIs participating in a CMMI ACO model. CMS could use the threshold that is Technical Changes NAACOS supports the following proposals to make technical changes to references in MSSP regulations, which will eliminate existing errors and inconsistencies and improve clarity in the regulatory text:

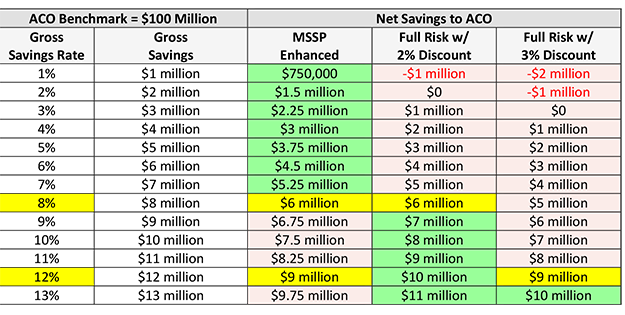

Future Developments for Shared Savings Program NAACOS has advocated that CMS leverage MSSP as an innovation platform, and we applaud CMS for seeking input on ways to bring more innovation into the program. Additionally, NAACOS is pleased to see CMS mention an option to provide prospective payment for primary care within MSSP as a strategy to support care delivery transformation, strengthen primary care, and increase participation in ACO initiatives. NAACOS and others have called on CMS to implement such an option and outlined payment approaches that accommodate the differing needs and capabilities of various primary care practice types. We encourage CMS to move forward swiftly and begin offering this option in MSSP to coincide with the start of the Innovation Center's Making Care Primary Model. Incorporating a Higher Risk Track than Enhanced Our concept for “Enhanced Plus” would offer a bridge between Enhanced and what today is ACO REACH, all while providing more flexibility and innovation that allow providers to deliver optimal patient care in ways that best suit them and their populations. Now is an appropriate time for CMS to consider an Enhanced Plus option. With ACO REACH scheduled to sunset at the end of 2026, there's growing uncertainty around what model is next for REACH ACOs. An Enhanced Plus option could provide an on-ramp to MSSP, which was lacking when Next Gen expired at the end of 2021. Below our recommendations offer approaches that would encourage adoption of a risk track higher than Enhanced by ACOs currently in MSSP or REACH. First, CMS should give ACOs a choice between a full-risk option with a discount or a shared savings rate of 85 percent or 90 percent. There is precedence as ACO REACH offers two levels of risk and Next Gen offered options for percent shared savings (80 or 100), variable discounts, and caps on savings and loss rates between 5 percent and 15 percent. These options provide a tradeoff between how much ACOs could pay back to the Medicare trust fund or reinvest in incentives or patient care. These varied approaches are needed to consider the financial incentives for ACOs. For example, the chart below demonstrates potential financial incentives under Enhanced and a theoretical Enhanced Plus. Today, the Enhanced track offers a 75 percent shared savings rate and a 40 percent shared loss rate. In a full-risk model with either a 2 percent or 3 percent discount, ACOs would have to generate savings of 8 percent or 12 percent, respectively, to earn more than in Enhanced. Another consideration is to set the discount to max out at half of the average shared savings earned for the program. For example, if ACOs in the track averaged 5 percent savings for a particular year, the discount would top out at 2.5 percent. This would avoid current challenges in ACO REACH where the average net savings for standard ACOs was less than 1 percent in 2021 after the discount. We understand that CMS must balance savings to Medicare with incentives to attract providers in the model.

It will be critical for CMS to also consider non-financial incentives to entice participation in a full-risk model given the relative attractiveness of the current Enhanced model. Few ACOs can generate the levels of savings needed to make a full-risk model with a discount more attractive. The answer lies in waivers and other non-financial incentives, which we spell out below.

In the RFI, CMS asked questions about how to protect the Medicare trust fund if only highly confident or successful ACOs joined a potential Enhanced Plus model or ACOs who may avoid high-cost patients. NAACOS believes there's robust experience around risk corridors in Innovation Center models and a truncation factor in MSSP. Additionally, other aspects of ACO policy, such as benchmarks, risk adjustment and attribution, should be structured to ensure that ACOs can adequately care for high-cost patients. CMS should expect highly confident and successful ACOs to join this new track. CMS's aim should not be to attract unsuccessful ACOs but to ensure it designs a model that will generate savings to Medicare while providing ACOs with stable benchmarks and the flexibility to innovate and improve patient care. As an option, CMS could employ an early termination policy as was done in REACH to prevent ACOs from leaving the program before the end of their agreement period if the model became financially unfavorable for them. NAACOS stands ready to work with CMS on developing more details around Enhanced Plus. We, however, caution CMS that it should still explore ways to offer successful waivers and innovations to ACOs in the Basic Track and Enhanced. Increasing the Amount of the Prior Savings Adjustment NAACOS appreciates CMS's openness to modifying prior savings adjustment. In our comments on last year's fee schedule, we offered several ways to strengthen the prior savings adjustment.

NAACOS supports CMS's efforts to account for prior savings when ACO benchmarks are rebased under a new agreement period as this will help CMS retain ACOs in the program long-term. NAACOS appreciates policies that reward strong performance and further incent a transition away from FFS. We feel there are ways to strengthen this policy that are important to consider as we deal with the ratchet effect that comes from continual rebasing. It's important to remember that any move to administrative benchmarks won't solve this problem of benchmarks starting off at unachievably low levels because of ratcheting due to rebasing. This ratchet does not just cap savings, it caps investments in beneficiaries, and it caps how much an ACO can truly transition away from FFS and towards value. As CMS looks to solve the ratchet effect, it's important to remember this could be solved by increasing both the regional adjustment and prior savings adjustment. The size of the ratchet depends on how efficient the region is, and ACOs in more efficient regions need a higher prior savings adjustment to offset the lack of help provided by the regional adjustment. Expanding the ACPT Over Time and Addressing Overall Market-wide Ratchet Effects NAACOS appreciates CMS looking at future refinements to the ACPT given our concerns with its implementation, which included calling for a pause on it starting in 2024. In last year's rulemaking, we asked that CMS keep the current two-way trend that uses a blend of national and regional spending but recommended two changes: CMS (1) use the ACPT as the national component of the trend adjustment, rather than observed national FFS spending and (2) remove ACO-assigned beneficiaries from the regional comparison group, negating the effect of ACOs' savings on the regional trend. This would still allow CMS to move toward its goal of an administratively set benchmark while minimizing the unintended consequences of harming nearly a third of ACOs. Our concern with the ACPT hinges on the fact that national spending is not reflective of the spending trends in an ACO's region. When an ACO's regional trend is lower than national spending increases, the ACO would be negatively impacted. ACOs should not be punished if they operate in regions with spending growth below that of national inflation. Replacing the national trend in the current two-way blend with the ACPT is a step in the right direction. It creates a benchmark that is based less on national spending and more on regional spending, which is a policy NAACOS has long advocated for. NAACOS continues to ask that guardrails be put into place to protect ACOs who would see lower benchmarks because of the ACPT. These include:

Promoting ACO and CBO Collaboration New codes for community health integration and SDOH risk assessment, proposed in this rule, will help support these efforts by providing payment for screening patients for SDOH and social risk factors, and for activities to address SDOH and HRSNs. We encourage CMS to do more to incorporate social risk into financial benchmarks to reflect the cost of improving outcomes more accurately for beneficiaries affected by SDOH and HRSNs. These beneficiaries may have significant unmet need due to historical lack of access, making risk scores based on historic utilization appear low. Combined with the cap on risk score growth in MSSP, these policies significantly underestimate the resources required to care for underserved beneficiaries and create financial challenges for ACOs providing this care. Another challenge that ACOs frequently cite is the structure of the current Beneficiary Incentive Program (BIP), which lacks flexibility to tailor the program to the needs of an ACO's population. While this program was established by Congress and will require statutory changes, there are opportunities for CMS to improve the process for updating waivers available in MSSP. We urge CMS to avoid creating new requirements, which may limit ACOs' flexibility to tailor to their unique populations and increase burden, and instead focus on addressing existing barriers. Rather than making changes to the patient-centeredness criteria, CMS could, for example, provide additional guidance and resources to ACOs looking to establish new partnerships with community stakeholders, and conduct outreach and provide support to CBOs interested in ACO partnerships. NAACOS looks forward to working with CMS and the ACO community to advance this important work. Beneficiary Notification Requirements While CMS does not propose any changes to the MSSP beneficiary notification requirements in this rule, NAACOS would like to reiterate concerns with the requirements as currently written and highlight key challenges ACOs face in implementing and complying with these requirements. Beneficiary notifications were required in the early years of MSSP, and the requirement was later removed due to the administrative burden, beneficiary confusion, and operational complexity caused by the notifications. CMS later reintroduced the requirement and made changes to the policies but has not addressed the fundamental issues with the requirement. In last year's rulemaking, CMS added a follow-up communication requirement in conjunction with the notice, which NAACOS opposed due to concerns it would exacerbate beneficiary confusion and operational complexity. ACOs have struggled in implementing this new element of the requirement and CMS did not provide any guidance on the follow-up requirement until April 2023, nearly four months after the requirement went into effect, and the guidance and FAQs provided failed to answer numerous questions about compliance or CMS's expectations for ACOs. NAACOS has received dozens of questions and concerns about these requirements from ACO members, and from these we have outlined four overarching issues with the beneficiary notification requirements as currently written, detailed below. First, ACOs that have elected preliminary prospective assignment with retrospective reconciliation (retrospective assignment) struggle to identify the denominator of beneficiaries to which they are required to provide the notice and follow-up. While ACOs with prospective assignment are only required to provide these to prospectively assigned beneficiaries, ACOs with retrospective assignment are required to provide them to all Medicare FFS beneficiaries. CMS provides these ACOs with information on preliminarily assigned (ALR Table 1-1) and assignable (ALR Table 1-6) beneficiaries but does not provide a list of or contact information for all FFS beneficiaries, making it infeasible for ACOs to identify and contact these beneficiaries to comply with the requirements. While CMS attempted to alleviate some burden by reducing the frequency with which ACOs must provide the notice, many ACOs' compositions change significantly from year to year, with hundreds of new providers and thousands of new beneficiaries, making it incredibly challenging to identify all “new beneficiaries” each performance year. As such, some ACOs have expressed they may have to continue sending the notice to all beneficiaries in order to be compliant. Second, the timing requirements of the initial notice and follow-up are impractical and make it effectively impossible to be fully in compliance. Under current regulations, ACOs are required to provide the notice at or before the first primary care service visit of the performance year and provide the follow-up “no later than the earlier of the beneficiary's next primary care service visit or 180 days from the date the standardized written notice was provided.” Some beneficiaries will inevitably have a primary care visit on January 2 and ACOs do not receive attribution lists for the upcoming performance year until December, leaving very little time to send notifications by January 1. Requiring clinic staff to furnish the notice at point of care adds significant administrative burden—including staff training, changing workflows, and documenting and tracking when beneficiaries receive the notice—to primary care practices, many of which are experiencing staffing shortages and high levels of burnout. The timing of the follow-up communication poses even more challenges. Many ACOs do not have access to practice-level scheduling data to determine whether the beneficiary's next primary care visit takes place before the end of the 180-day period after the notice was provided. At a minimum, CMS should only require the follow-up communication within 180 days, removing “the next primary care service visit” as it is a difficult and impractical standard for all ACOs to track. Third, lack of appropriate guidance from CMS and contradictory information provided by ACO coordinators have caused significant confusion among ACOs about how to comply with the requirements. As previously mentioned, written guidance documents from CMS fail to answer questions about implementation, required documentation, and what CMS considers to constitute compliance with the requirements. Additionally, because this guidance was not published until the second quarter of the year, some ACOs had to re-do many of the notifications to comply with the guidelines, adding costs and administrative burden. ACOs that have contacted their ACO coordinators with questions about these requirements have received information that contradicts answers provided by other ACO coordinators or conflicts with guidance and statements made by CMS. For example, some ACOs were told by their ACO coordinators that the follow-up communication could be packaged with the initial notification (e.g., included as a cover letter or additional attachment with the standard written notice) while others were told it must be provided in a separate communication after providing the written notice. Later, CMS stated verbally that the follow-up communication must be provided on a separate day (calendar day vs. 24-hour period not specified) from the initial notice but has not included that information in any written guidance. Similarly, ACOs have received contradictory information on whether sending notices to potentially assignable (ALR Table 1-6) beneficiaries would satisfy the requirements. Given the broad confusion and contradictory information that has been provided to ACOs about these requirements, ACOs are concerned about compliance action in the event of an audit. ACO compliance officers dedicate time and resources to ensure ACOs are in compliance with MSSP regulations, and they cannot do this effectively if CMS cannot clearly define what is required of ACOs and what would satisfy an audit. Finally, and perhaps most importantly, these requirements have caused confusion and frustration for Medicare beneficiaries, in direct contrast with the intention of the requirements. NAACOS strongly supports efforts to improve beneficiary education and engagement, and we are concerned to hear from ACOs, Medicare beneficiaries, and consumer advocates that the current beneficiary notifications are having the opposite effect. As a result of the notifications, some beneficiaries choose to opt-out of data sharing without understanding what the data sharing process entails, making it difficult for ACOs to coordinate and manage patients' care effectively. NAACOS members have reported that after sending the notice, many saw between 2 percent and 5 percent of patients opt-out of data sharing. The new follow-up communication has increased confusion and frustration. Some patients believe these communications are part of a scam, or that they have been enrolled in a managed care plan without their consent. ACOs have also reported that after providing the follow-up communication, they received a high volume of patient calls about clinical care, coverage issues, and questions about medication management, none of which were relevant to MSSP or appropriate for ACO operational staff to address. Medicare beneficiaries and consumer advocates have also expressed concerns that these notifications do not resonate with patients and may exacerbate mistrust in the health care system. In a January 2023 panel discussion with Medicare ACO beneficiary board representatives, the representatives felt strongly that the current notice is not helpful and does not include information that matters to patients and expressed that CMS should take a more active role in educating beneficiaries about ACOs. One suggestion from the panel that NAACOS has also recommended is to provide information on ACOs and the benefits of the shift to value-based care in the “Medicare & You” handbook. The 2023 handbook contains no direct mention of MSSP and includes less than two pages on ACOs. In contrast, Medicare Advantage (MA) is mentioned twice in the table of contents alone and has an entire section of the handbook dedicated to detailing various plans and options available under MA and how to enroll. In order to engage beneficiaries in accountable care, the first step is to educate them about the existence of the program and what it means for their care. Not including comprehensive information in plain language about MSSP and ACOs broadly in the “Medicare & You” handbook is a missed opportunity to open the conversation about accountable care with beneficiaries. NAACOS is a strong supporter of CMS's goal to have all Medicare beneficiaries in a relationship with a provider accountable for their quality and total cost of care by 2030. Effectively communicating with and educating beneficiaries about accountable care will be essential to achieving this goal. NAACOS will continue to engage with CMS and other stakeholders, including patients and consumer advocates, to improve beneficiary communications as they are critical to expanding the reach of accountable care and to the success of patient engagement activities. We plan to convene a group of ACO leaders and consumer advocates to develop commonsense solutions to these challenges and we look forward to sharing the resulting recommendations with CMS. Proposals to Align CEHRT Requirements for Shared Savings Program ACOs with MIPS NAACOS strongly opposes CMS proposals to align CEHRT requirements for MSSP ACOs with MIPS and we urge CMS to reconsider this policy. By requiring all ACOs to report Promoting Interoperability, regardless of track or qualifying APM participant (QP) status, CMS is creating yet another disincentive for ACOs to participate in an Advanced APM and obtain QP status. CMS notes their intention with this proposal is to reduce burdens for ACOs, however the result is the opposite. Instead, CMS is now creating a new reporting obligation for ACOs who participate in an Advanced APM and obtain QP status. Lastly, QPs are statutorily excluded from the MIPS program and this proposal would essentially subject QPs to MIPS as Promoting Interoperability is the only reporting obligation ACOs have in the program. QUALITY PAYMENT PROGRAMMerit Based Incentive Payment System MIPS Value Pathways (MVP) Reporting for Specialists in Shared Savings Program ACOs MIPS Payment Adjustments and ACO Expenditures Request for Information on MIPS Incentives to Advance Alternative Payment Models Overall, MACRA's incentives have driven change in the Medicare payment system, but the incentive structure needs to be revisited for growth to continue. It's clear that advanced APMs are transforming how patients in traditional Medicare receive care and achieving cost savings. If the 5 percent advanced APM incentive payments expire this year, and qualifying thresholds increase to unattainable levels, there will be a significant reduction in the move to value. Increasing thresholds and expiring incentives could result in a 32–42 percent drop in participation. A shift back to FFS for these clinicians could possibly increase total Medicare spending annually by $714 to 882 million. Additionally, successful transition to value-based care models requires clinicians to invest in workflow improvements, digital health tools, care coordinators, data analytics, quality measurement systems, transitional care services, and innovative patient engagement methods. While these advanced care delivery tools help improve patient care and outcomes, it is not without a cost. Incentive payments have been critical in helping clinicians make these initial investments and continue reinvesting in these care transformation initiatives that benefit patients. CMS should work with Congress to provide an initial short-term extension of MACRA's incentives and consider more sustainable longer-term incentive payments system that helps clinicians move away from standard FFS. Specifically, incentives are the building blocks to care transformation and CMS should consider the following:

Within MIPS, CMS should use its current authority to further encourage the adoption of APMs by:

Reduce burden for ACOs who are included in MIPS. This includes not moving forward with the additional Promoting Interoperability requirement as proposed (detailed above), limiting annual changes to program criteria, focusing on more meaningful measurement, and providing more ACO-specific MIPS guidance. Advanced Alternative Payment Models QP Determinations Additionally, NAACOS is concerned that making QP determinations only at the individual level will increase burden as some clinicians in the ACO will qualify as QPs and others will not. This means the ACO will now have to support some clinicians with participation in MIPS. We recommend that the agency maintain the current attribution definition for determinations at the APM entity level and use the new proposed definition of attribution-eligible beneficiary for determinations at the NPI level. It is hard to determine the impact of the change for either APM entity or individual QP determination. We ask CMS to produce some additional data on the impact of this definition change and specifically, the impact on ACOs. Differential Conversion Factor Impact on Benchmarks CONCLUSIONThank you for the opportunity to provide feedback on CY2024 Medicare Physician Fee Schedule and MSSP proposed rule. NAACOS and its members are committed to providing the highest quality care for patients while advancing population health goals for the communities they serve. We look forward to our continued engagement on improving and enhancing MSSP. If you have any questions, please contact Aisha Pittman, senior vice president, government affairs at [email protected]. Sincerely,

Clif Gaus, Sc.D. |